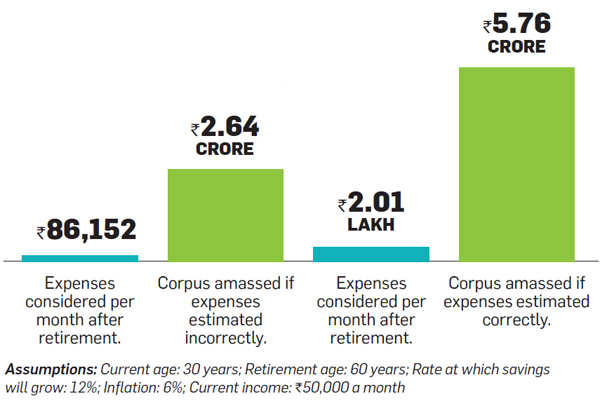

Underestimating expenses

If you think your expenses will fall after retirement, think again. While kid-related expenditure and debt come down, there is a rise in medical and travel costs. This may result in an insufficient corpus that may not last too long. This can also happen if you ignore inflation, which leads to wealth erosion over time.

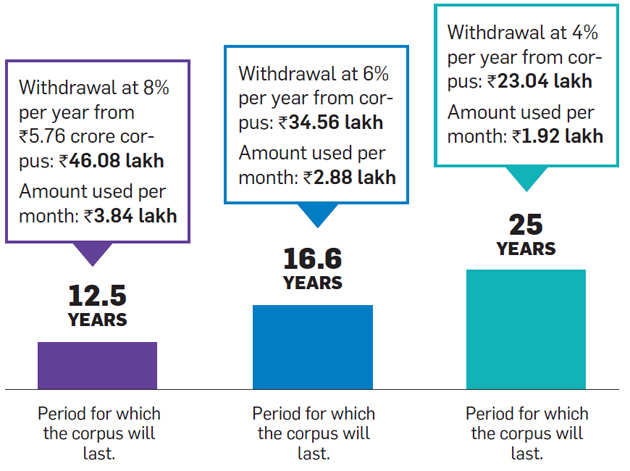

When you get a lump sum on retirement in the form of PF or gratuity, you are under the illusion that there is lot of money. If you start withdrawing at the rate of 10%, even as the corpus grows at 7%, you will soon run out of money. The rise in survival rate also means that you will live longer. Hence, the need to withdraw at a rate lower than the one at which your money grows.

Not diversifying

Correct asset allocation is critical to ensuring that the corpus lasts longer. While you need to bring down the equity component to reduce risk, it is imperative that you invest in equity to beat inflation and make your money stretch. "Another problem is being houserich and money poor, wherein the parents may have to depend on children for money. Choosing tax-inefficient instruments also erodes the corpus, which is why fixed deposits may not be the best idea. Instead, go for balanced funds, which become tax-free after a year.

How long will the money last if you withdraw more?

Given that there is spate in medical problems after retirement, you should review your health insurance or have a sufficient buffer. As for life insurance, you will not need it unless you have dependants or there are maturity benefits, and can end it after retiring.

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

No comments:

Post a Comment