This saves you from the practice of sending paper acknowledgment to the Centralised Processing Centre (CPC) of the IT department located in Bengaluru.

However, if you want you can still use your paid tax challan to verify your ITR and send the paper acknowledgment called ITR-V through post to the Bengaluru based CPC.

Here is how you can e-verify your ITR via net banking Those taxpayers who have activated internet banking facility can do the e-verification. Once logged in to the banking portal, the taxpayer will be sent Electronic Verification Code (EVC) on his/her mobile number provided to the official e-filing portal of the IT department. This is the same EVC which tax payers will have to put in their ITR for final submission.

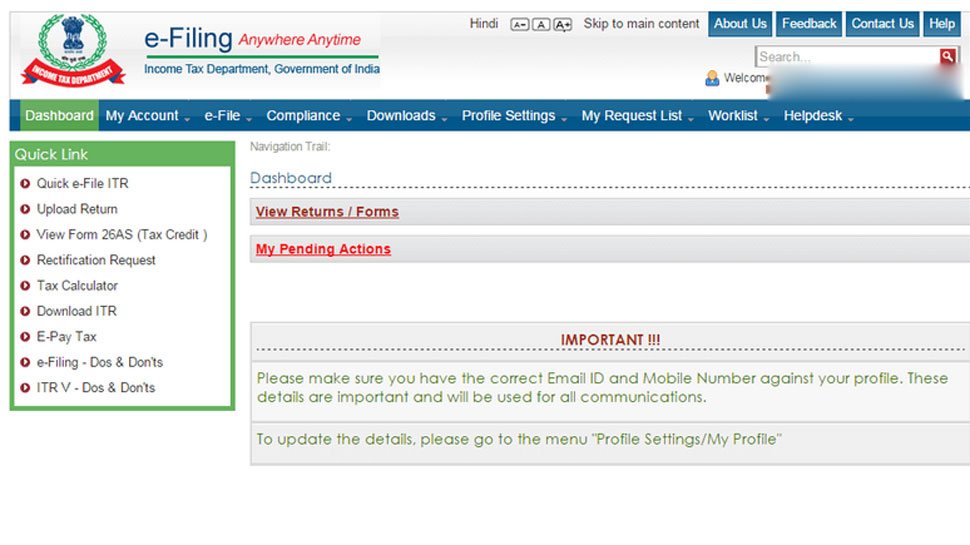

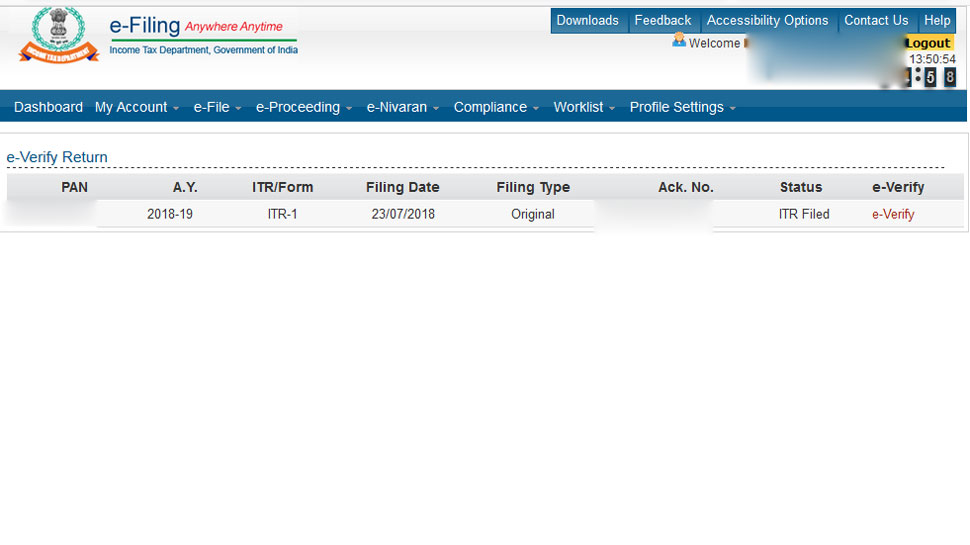

Those taxpayers who have activated internet banking facility can do the e-verification. Once logged in to the banking portal, the taxpayer will be sent Electronic Verification Code (EVC) on his/her mobile number provided to the official e-filing portal of the IT department. This is the same EVC which tax payers will have to put in their ITR for final submission. Log on to your net banking option of your bank. In the quick link, select the e-verification tab.

Log on to your net banking option of your bank. In the quick link, select the e-verification tab.

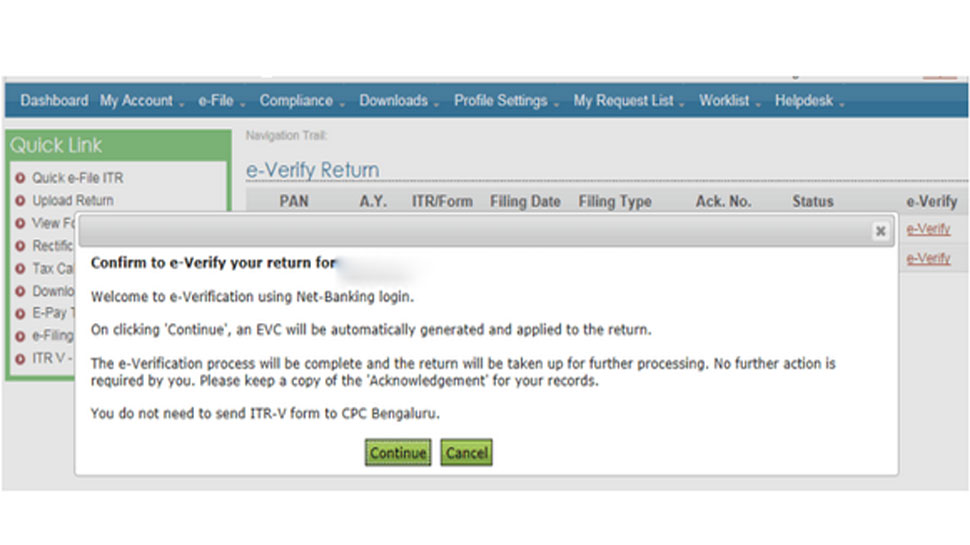

Now select the confirmation tab that asks you to e-verify your return based on an EVC

Now select the confirmation tab that asks you to e-verify your return based on an EVC

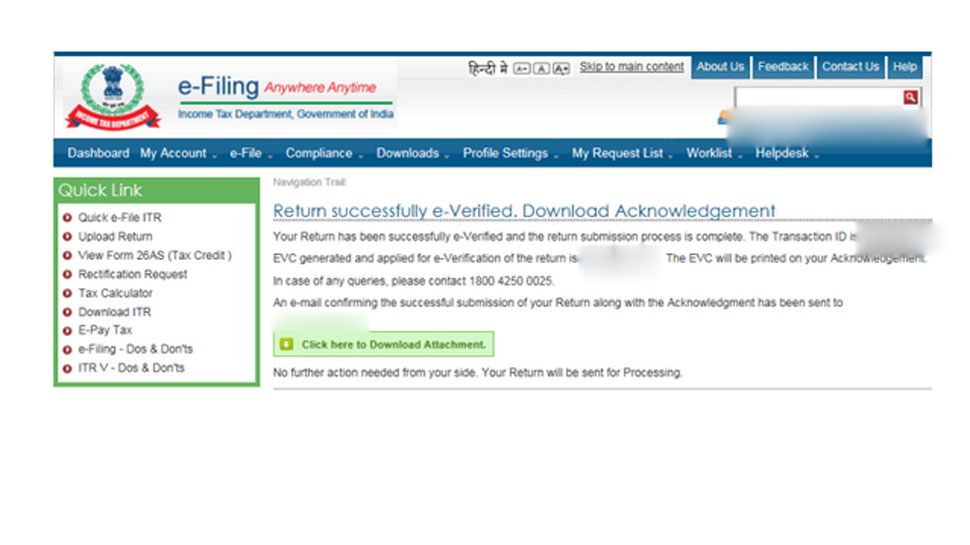

Once you confirm the e-verification using the EVC, you will get a confirmation message of successful e-verification. This will have the details of your transaction ID and EVC code.

Once you confirm the e-verification using the EVC, you will get a confirmation message of successful e-verification. This will have the details of your transaction ID and EVC code.

Keep it for further reference.

The online ITR filing portal of the department is available at https://incometaxindiaefiling.Gov.In. Do note that e-verification of your ITR can be done within 120 days from filing ITR.

SIPs are Best Investments as Stock Market s are move up and down. Volatile is your best friend in making Money and creating enormous Wealth, If you have patience and long term Investing orientation. Invest in Best SIP Mutual Funds and get good returns over a period of time. Know which are the Top SIP Funds to Invest Save Tax Get Rich - Best ELSS Funds

For more information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

No comments:

Post a Comment