The permanent portfolio concept was introduced by investment analyst Harry Browne in his book Fail Safe Investing . This strategy helps cushion the fall in one asset class in a particular market environment by the rise in another in the same environment. For example, equity does well when the economy is in a boom phase, but fares badly during a recession.

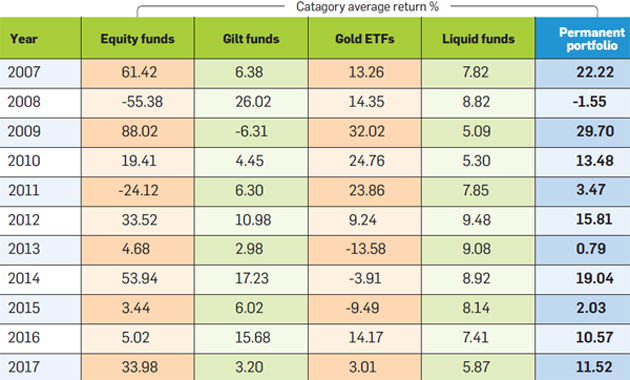

A permanent portfolio cushions investors against a sharp fall in either of the four asset classes.

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

No comments:

Post a Comment