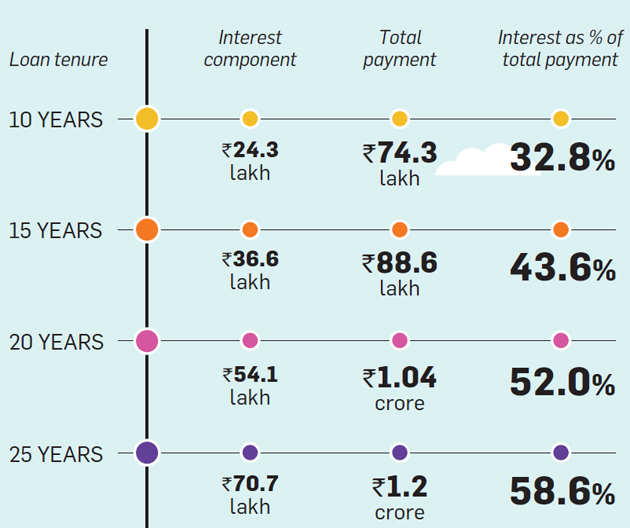

If you took a home loan of Rs 50 lakh at 8.5% interest:

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

No comments:

Post a Comment